“The social function of the doctrine of ‘sound finance’ is to make the level of employment dependent on the state of confidence.”

It really is amazing how good this essay is.

h/t Chris Dillow

“The social function of the doctrine of ‘sound finance’ is to make the level of employment dependent on the state of confidence.”

It really is amazing how good this essay is.

h/t Chris Dillow

The has been a growing argument that as Paul Krugman puts it,

[we] seem to be seeing a general shift in the sources of rising inequality, from inequality in compensation to good old-fashioned capital versus labor.

In other words if you want to get ahead in life, don’t get an education, get rich parents. Or to put it otherwise, increasingly, people who earn loads of money don’t get paid it for their skilled labour, then earn it from returns on capital.

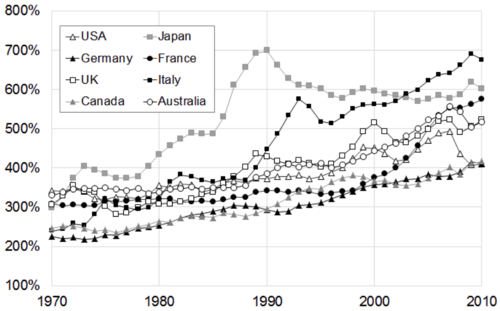

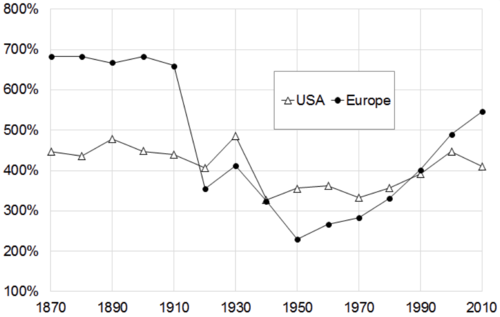

In a new VOX article, based on a paywalled (grrr) article “Capital is back: wealth-to-income ratios in rich countries, 1700-2010”, Piketty and Zucman give us a few nice graphs. I’m just C&Ping them below…

Figure 1. Private wealth / national income ratios, 1970-2010

Figure 2. Private wealth / national income ratios, 1870-2010: Europe vs. USA

Figure 3. Capital shares in factor-price national income, 1975-2010

And early post linked to Isaac Deutsher’s wonderful essay “The Ex-communist’s conscience” and I said I would say a bit more about Deutscher.

Deutscher of course lends his name to the Isaac and Tamara Deutscher Memorial Prize, which is awarded every year for the best book in Marxism and is one of the few book awards worth paying attention to. The reason I mention this is because receiving the award brings with it the compulsion to give an lecture. One particularly interesting lecture given in this circumstance was Justin Rosenberg, who had been given the award for his book “The Empire of Civil Society”. Available on amazon and libcom.

Rosenberg’s lecture was on “Isaac Deutscher and the Lost History of International Relations”. It is a fascinating little essay/lecture and I very strongly recommend reading it.

I had always thought the idea of Combined and Uneven Development was a load of nonsense and Rosenberg’s essay has convinced me its not. There’s something there.

Rosenberg is running a research group in Sussex on this question and you can read about it on their site: http://unevenandcombineddevelopment.wordpress.com/

Fourier on sexual liberation in his early 19th century socialist utopia:

Love in Harmony [i.e. the Phalanx] will be ‘free,’ but highly organized, the aim being to provide universal sexual gratification. Everyone, including the elderly and the deformed, will be assured of a ‘sexual minimum’. To effect this, philanthropic corporations composed of outstandingly beautiful and promiscuous erotic priests and priestesses will joyfully minister to the needs of less attractive Harmonians. The qualification for admission to this ‘amorous nobility’ will be a generous sexual nature, capable of carrying on several affairs at once (this will be tested under examination conditions). Polygamy and adultery will be praiseworthy in Harmony, and they will be open and unashamed – there will be no secrecy – whereas monogamy will be despised as the narrowest sort of love. Polygamy, Fourier believed, was already almost universal – though covert – in our own civilization. He drew up a list of seventy-two distinct varieties of cuckold.

In Harmony, the notion of sexual ‘perversion’ will be abandoned. Lesbians, pederasts, flagellants, and others with more recondite tastes such as heel-scratching and eating live spiders, will all have their desires recognized and satisfied, and will meet regularly at international convocations. Fourier himself confessed to a fondness for lesbians, and calculated that there were 26,400 men on earth, beside himself, who shared this abnormality.

The amorous affairs of each Phalanx will be organized by an elaborate hierarchy of officials, titled variously high priests, pontiffs, matrons, confessors, fairies, fakirs, and genies. They will hold sessions of the court of love each evening, after the children have gone to bed. In arranging relationships, they will depend on a complete knowledge of everyone’s likes and dislikes, obtained through confession, and an intricate card-index system of erotic personality-matching.

The quote is from The Faber Book of Utopias.

It is often heard from German polticians that Irish debt levels are the reasons for this problem. While every economically literate Irish person knows that’s not true.

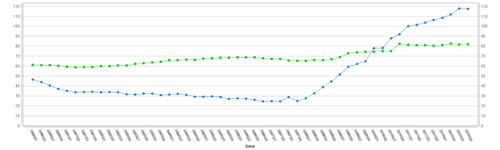

So here’s the graph:

Ireland is blue and Germany green. Five points:

1. Germany is on a clear, slow but steady upward trajectory throughout the period. Ireland on the other hand is on a clear, slow but steady downward trajectory up until the financial crisis.

2. It is clear that Ireland’s debt problems arose because of the the crisis, they did not cause them.

3. The upper limit for debt to GDP under the Copenhagen Criteria and the Stability and Growth Pact is 60%. That is basically where Germany starts and then rises above. With the exception of 2002, Germany has been in breach of the SGP consistently since 2013.

4. The gap between Irish debt levels and German debt level today is smaller than today than they were before the crisis. German debt was roughly 30-35 percentage points higher than Irish debt before the crisis. Irish debt/GDP is roughly 25-30 percentage points higher than Irish debt/GDP before the crisis.

5. Given all of this, it is clear that Ireland’s debt problems are not because of it’s pre-crisis debt level but rather from the rate of change of Ireland’s debt during the crisis. This is important because the increase in debt, arising largely from transfer payments*, could not have been avoided. Having a lower debt level to begin with would have had no impact here. In fact there if Ireland had entered the crisis with lower debt levels the relative increase increase in its debt would have been higher not lower. Perhaps, this might have been resulted in Irish interest rates increasing higher and faster than they actually did.

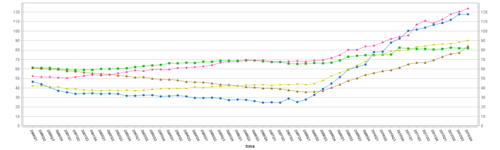

Finally, here is Spain (brown), Portugal (pink) and the UK (mustard?) added to the graph.

Again the argument for debt causing the crisis is hard to make. And the interest differential between Spain and the UK is clearly being driven, not by the debt level, but by something else…. I wonder what that could be?**

*Bank debt clearly matters here but its short run implications are actually more ambiguous than supposed.

** The answer is €

All data from Eurostat

This is pretty great. I’ve never sen a gif like this. I came across it via Kevin Drum at Mother Jones, but it actually comes from a speech by Alan Krueger, Chairman of the Council of Economic Advisers, last year. The gif has been put together for the Whitehouse’s tumblr of all places!!!

[youtube http://www.youtube.com/watch?v=ko5RVipAdrs?wmode=transparent&autohide=1&egm=0&hd=1&iv_load_policy=3&modestbranding=1&rel=0&showinfo=0&showsearch=0&w=500&h=375]

A song about wage agreements and the miners in the 60s. Worth reading the bits on this in Simon Clarke’s “Keynesianism, Monetarism and the Crisis of the State”

One of my regrets is that I did not make more of the fact that I was thought by Kevin O’Rourke in the final year of my undergraduate degree. He’s a great economist who, although not an anti-capitalist, has research interests that overlap heavily with mine. The ‘more’ in the title of this post refers to his latest post over at IrishEconomy:

The FT is full of depressing news stories this morning, none of which are surprising.

In the US, a Tea Party candidate won the Republican nomination for the Senate elections in Delaware.

In France, Sarkozy suggested that Luxembourg (home of the Commissioner who sharply criticized him for the Roma expulsions) would do well to welcome a few Roma itself.

In Sweden, the Sweden Democrats, a party with roots in the neo-Nazi movement, may be on the brink of an electoral breakthrough that might see it hold the balance of power after the elections there.

And the Japanese decision to weaken the yen is provoking tension with Europeans and Americans.

Lots of zero sum thinking out there this morning:history rhyming.

Via Brad De Long, a pretty interesting graph on the the changing degree of ‘improvement’ in the state of employment after the official end of recession.