It is often heard from German polticians that Irish debt levels are the reasons for this problem. While every economically literate Irish person knows that’s not true.

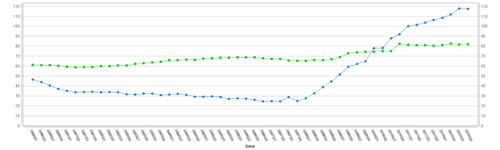

So here’s the graph:

Ireland is blue and Germany green. Five points:

1. Germany is on a clear, slow but steady upward trajectory throughout the period. Ireland on the other hand is on a clear, slow but steady downward trajectory up until the financial crisis.

2. It is clear that Ireland’s debt problems arose because of the the crisis, they did not cause them.

3. The upper limit for debt to GDP under the Copenhagen Criteria and the Stability and Growth Pact is 60%. That is basically where Germany starts and then rises above. With the exception of 2002, Germany has been in breach of the SGP consistently since 2013.

4. The gap between Irish debt levels and German debt level today is smaller than today than they were before the crisis. German debt was roughly 30-35 percentage points higher than Irish debt before the crisis. Irish debt/GDP is roughly 25-30 percentage points higher than Irish debt/GDP before the crisis.

5. Given all of this, it is clear that Ireland’s debt problems are not because of it’s pre-crisis debt level but rather from the rate of change of Ireland’s debt during the crisis. This is important because the increase in debt, arising largely from transfer payments*, could not have been avoided. Having a lower debt level to begin with would have had no impact here. In fact there if Ireland had entered the crisis with lower debt levels the relative increase increase in its debt would have been higher not lower. Perhaps, this might have been resulted in Irish interest rates increasing higher and faster than they actually did.

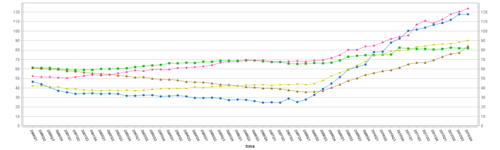

Finally, here is Spain (brown), Portugal (pink) and the UK (mustard?) added to the graph.

Again the argument for debt causing the crisis is hard to make. And the interest differential between Spain and the UK is clearly being driven, not by the debt level, but by something else…. I wonder what that could be?**

*Bank debt clearly matters here but its short run implications are actually more ambiguous than supposed.

** The answer is €

All data from Eurostat